Table of Content

Credit bureaus like Equifax, Experian and TransUnion collect this information from lenders and financial institutions and use it to build your credit reports. The information in those reports is then run through various credit-scoring models and, voilà, your scores come out on the other end. As we’ve seen in the sections above, this score impacts every aspect of your financial life.

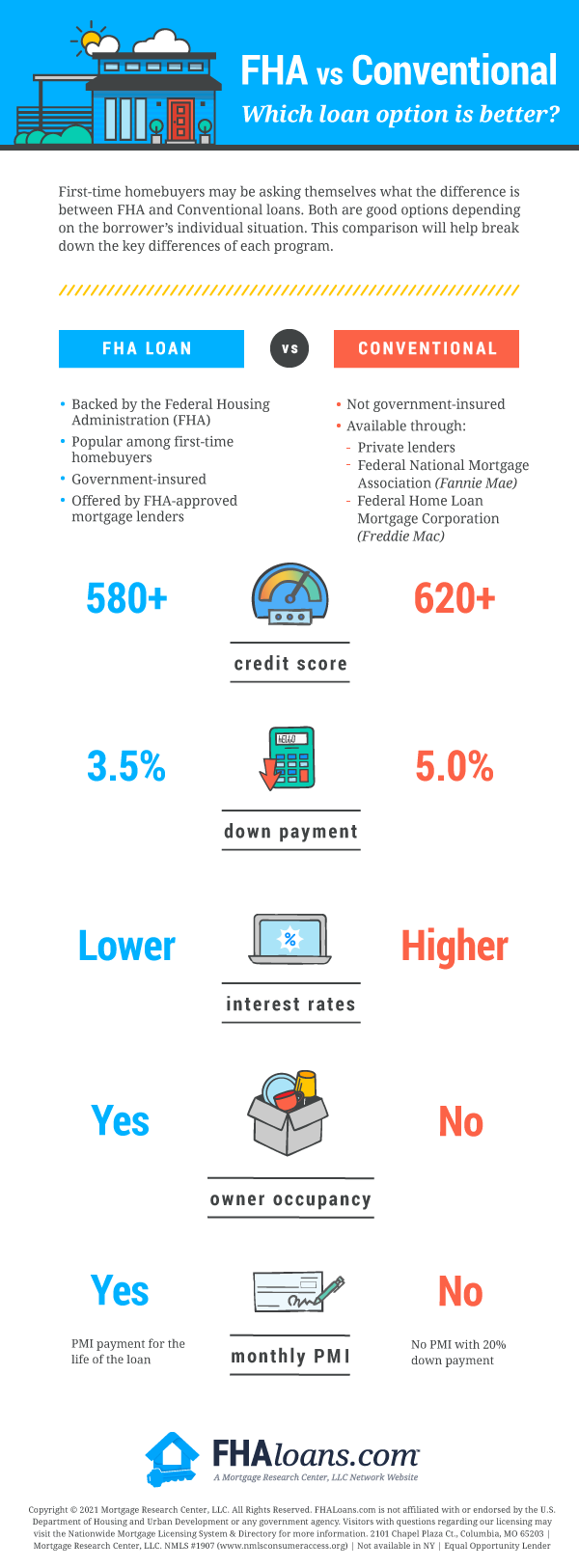

Offer down payments as low as 3.5% and low-equity refinances, which allow you to refinance up to 97.75% of your home’s value. Some Veterans think they will never qualify for a VA loan due to a low credit score. No matter what your credit is, it’s important to shop around to understand what competitive rates look like in your area. Compare current mortgage rates on Credit Karma to learn more. Let’s take a closer look at how to build credit so you can work toward better financial products. If you would like to improve your credit score of 580, there are a few ways you can go about it.

Can You Get a Mortgage with a 580 Credit Score?

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers.

If you wish to report an issue or seek an accommodation, please let us know. Check your buying power by getting pre-qualified for a mortgage with us at Zillow Home Loans. DON’T close an account to remove it from your report (it doesn’t work). However, the reason for your low score cannot be that you have burned creditors right and left.

Can You Buy A Home With A 580 Credit Score?

In the VantageScore model, 580 falls squarely in the poor credit range. In either case, a score of 580 is below the average credit score. It’s best to avoid payday loans and high-interest personal loans as they create long-term debt problems and just contribute to a further decline in credit score. One of the best ways to build credit is by being added as an authorized user by someone who already has great credit.

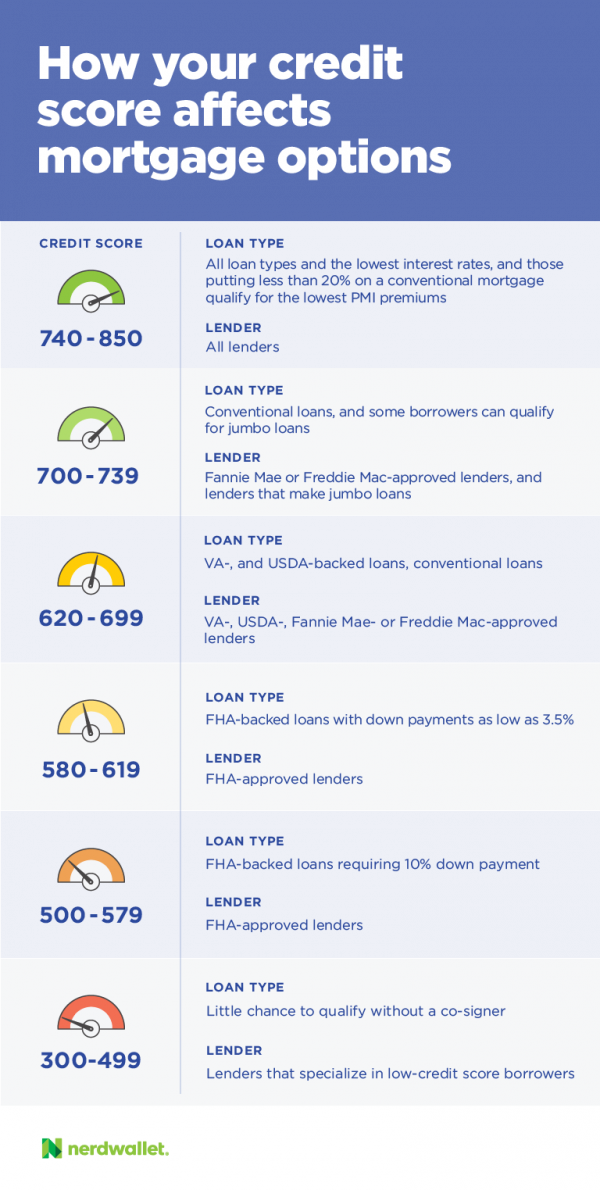

Debt-to-income ratio, or DTI, is the percentage of your gross monthly income that goes toward paying off debt. Again, having less debt in relation to your income makes you less risky to the lender, which means you’re able to safely borrow more on your mortgage. If you're applying for a loan on your own, lenders get your credit score from each of the three major credit rating agencies and use the middle or median score to qualify you. Let’s dive in and look at the credit score you’ll need to buy a house, which loan types are best for certain credit ranges and how to boost your credit.

Take control of your credit today.

An FHA loan is accessible with a credit score as low as 580 or 500, depending on the down payment amount. That said, taking out an FHA loan with a very low credit score can still be a challenge, since lenders can impose their own higher credit minimums. Residents of Mississippi have the lowest average credit scores nationwide at 681. Experts recommend keeping your credit utilization ratio below 30% on each card and on your overall credit in general.

While mortgage lenders are allowed to approved loans for 580 credit scores, they aren’t required to. For a standard FHA loan, a minimum of one credit score is required to qualify. If your lender obtains all three of your credit scores, it will use the middle score for consideration. If you apply for a mortgage with your spouse, lenders will use the lower of the two middle credit scores. However, FHA loans are originated by private lenders, and these lenders will usually have their own minimum credit score requirements. For instance, the minimum FICO® Score for an FHA loan through Rocket Mortgage® is 580.

You’re our first priority.Every time.

Credit scores typically range from 300 to 850, and borrowers within a certain range can qualify for mortgage loans. While you don't need a perfect 850 credit score to get the best mortgage rates, there are general credit score requirements you will need to meet in order to take out a mortgage. A low credit score can be a sign to lenders that you’ve had credit challenges in the past — or that you’re just beginning your credit journey. It may be difficult to get approved for loans without very high interest rates until you’ve had a chance to build your credit. Knowing how to read and understand your free credit scores and free credit reports from Credit Karma can help you take the next step.

Contrary to how it sounds, though, you don’t have to buy a farm or take up farming yourself if you get a USDA loan. So you are not allowed to use the house for commercial purposes even if the property might contain certain features. For FHA loans, it does not matter where your house is located, so you have more freedom to choose where to settle down. If your FICO is significantly lower than 686 , your downpayment and DTI should probably be better-than-average to get approved.

On the other hand, if your goal with a personal loan is to finance a major purchase, you should ask yourself whether it’s something you need right now. If it can wait until after you spend some time building credit, you may qualify for a personal loan with a lower APR and better terms later down the line. If you’ve looked into all of these options and still can’t find a card that you can get approved for, you may have other options. Consider asking a family member or trusted friend to add you to their credit card account as an authorized user.

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

If you are shopping around with different lenders for a lower interest rate, there is generally a grace period of about 30 days before your score is affected. If you’ve seen your credit report and know your credit score, you’ve made the first step in the mortgage application process. The next step is finding out what kind of loan you should be aiming for to have a higher chance of getting approved. On average, all monthly account payments for approved borrowers equal 42 percent of their gross income. FHA allows you to get a 96.5 percent mortgage with credit scores down to 580, and requires ten percent down with a FICO as low as 500. Similarly, the interest rate on a car loan for someone with Fair credit can be upward of 14 percent — that number is closer to three percent with Excellent credit.

With a poor credit score, you might have trouble qualifying for credit. Maybe you’ve already been rejected for a credit card you’ve had your eye on, or maybe you only seem to qualify for loans with high interest rates and fees. Credit bureau Experian doesn’t use the term bad credit, but it does consider any score below 580 to be very poor credit.

Very few personal loan lenders will approve you for a personal loan with a 580 credit score. But, personal loans from these lenders come with high interest rates. Of course, every lender has different underwriting standards, so credit score qualifications can vary. And your ability to repay plays the most important role in getting approved for a home loan. To determine that, lenders review your monthly income minus your recurring debts (your debt-to-income ratio), as well as how much money you're putting down (loan-to-value). It still may be possible for lenders to give you a loan, provided your credit score is not too low.